Stamp Collectors

- What our clients Say About Us

- Collectors

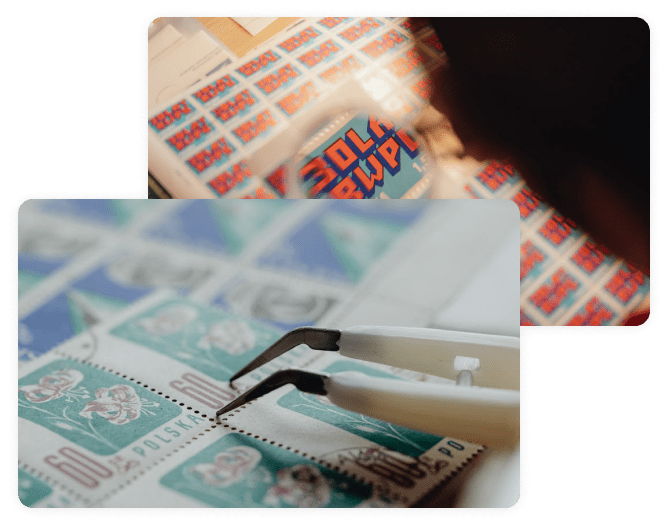

Safeguarding Your Stamp Collection

Are you a passionate stamp collector with a treasured collection of rare and valuable stamps?

Your collection represents not only a significant financial investment but also the culmination of many, many years of dedication. Protecting your beloved stamps is of the utmost importance.

That’s where our specialist Stamp Collectors Insurance comes into play.

Protection Against Unforeseen Events

Accidents happen. Whether it’s a fire or flood, theft, burst pipe, accidental damage or loss or damage in transit, the unforeseen can have a catastrophic impact on your collection. Insuring your collection ensures that you’ll have the financial resources to recover or replace your collection in the event of such disasters. Without insurance, the loss could be irreplaceable.

Peace of Mind

Knowing that your stamp collection is insured offers peace of mind that can’t be overstated. You can enjoy your collection without worrying about the what-ifs.

- Get Insurance

Get your Personalised Insurance Today!

Experience the peace of mind that comes with a personalised insurance plan crafted just for you.

Contact us today to start protecting what matters most.

Customized Coverage

Tailor your insurance to match the unique needs and value of your stamp collection.

Comprehensive Protection

Safeguard your stamps from theft, damage, loss, and unforeseen disasters.

Expert Appraisal Assistance

Benefit from our appraisal services to ensure your stamps are adequately insured.

- More From Us

Stamp and coin Collection Insurance

Stand-Alone Stamp Insurance

We offer a stand-alone stamp collectors insurance policy, which is independent of your home insurance and includes cover for your stamps, covers, envelopes, albums, philatelic literature, frames and other items of postal or historic philatelic interest.

- All Risks cover, including loss or damage caused by fire and smoke, theft and malicious damage, burst pipes/escape of water, explosion as well as accidental damage and loss including whilst in transit

- Only single stamps, a pane, block or cover valued over £10,000 need to be specified on the policy

- Automatically covers your entire collection at your home, anywhere in the UK and up to 60 days in Europe including in transit, when on display at talks, presentations and other events or exhibition

- Up to £2,500 in value automatically covered for any one sending by post or courier (higher limits available upon request)

- Option to add Public Liability cover for exhibiting at Exhibitions or Fairs

- No policy excess but with option to increase excess in return for a discount

- Claims settlement is the cost of replacement on a like-for-like basis at todays prices

Why Home Insurance may not be suitable

Whilst many home insurance policies may include cover for Stamp Collections, it is vitally important that you check the small print.

Often Stamp Collections are only covered if they have been ‘specified’ on your policy, i.e. specifically noted and shown in writing on your Policy Schedule. Is yours?

Home Insurance policies often have an ‘inner limit’ for the value of any collection. Does yours?

Does your home insurance policy cover your collection whilst in transit to / from and whilst at fairs or exhibitions?

In the event of a claim, are you confident that your home insurer understands the value of your stamps and associated items?

- You can feel confident that your insurance needs are being handled by people who have a deeper understanding of your hobby and the value of stamp collections, experience often lacking when dealing with a general insurance company or broker.

- You will be dealing with a broker and Insurance company who understands and has the experience of settling stamp insurance claims

- Our policy can be customised to your needs and preferences. Whether you have a small or extensive collection, you can choose the cover that suits you best and can adjust your policy as your collection grows or changes.

- No excess to pay in the event of claim. Most home Insurance policies have an excess of up to £500.

- If you make a claim on your Stamp Collectors policy, it will not affect your no claims discount on your home insurance policy;

Summary of Cover

Download a PDF with more information about cover details.

Specialist cover for collectors

While stamp collecting can be a fulfilling and lucrative hobby, it’s essential to recognise the need to protect your investment. Stamp collection insurance provides a safety net, preserving your hard-earned financial investment from unexpected disasters and protecting the value for you and your family legacy.

With specialist cover, flexible options, and the peace of mind it offers, insuring your stamp collection is not just an option—it’s a must-have for every dedicated philatelist.

Don’t wait until it’s too late; protect your stamps and continue to enjoy your lifelong passion with confidence.

Private Collectors

We can offer stand-alone insurance as well as the ability to incorporate stamps and coins under a high value home insurance policy. Both options have their separate merits and dependent on what you require, we can advise which route would be the most beneficial for you.

- FAQ's

Frequently Asked Questions

Have questions about Magnet Insurance and our services? Find answers to common queries below.

If you can’t find the information you’re looking for, feel free to reach out to our customer support team for help.

Magnet Insurance offers a wide range of insurance products, including home and property insurance, specialty insurance for a wide range of hobby collections, including stamps, coins, medals, postcards, model railway and many more.

We like to think we experts in the field of insurance and will always go the extra mile to find the most suitable solution. We are proud of our excellent review scores and our staff our approachable, friendly and knowledgeable and will always treat you with respect and answer phones quickly!

Yes, just drop us an email or phone us with full details and 9 times out of 10 we can amend your current policy to reflect any changes to risk details of coverage.

We will issue your renewal invitation either by email or post, about 3 weeks before your policy expiry date. This will contain details of how to renew your policy.